|

|

|

|

|

Data Privacy and Data Security Challenges in Digital Finance

Michael Aderemi Adegbite 1

1 Independent

Researcher, Virginia, USA

|

|

ABSTRACT |

||

|

The rapid

development of digital financing brought new dimensions to financial services

and generated greater availability and efficiency. But also

it presents critical challenges in terms of the protection of personal data

and data security. The fact is that financial institutions and platforms are

processing FinTech’s processing of a large proportion of confidential

information about their customers, and thus guaranteed

the confidentiality, integrity and availability of data. These are the

priorities of this paper. To study the main challenges of maintaining the

privacy and safety of data in digital financing and to provide solutions for

threats such as cyberattacks, data violations and non-regulatory

compensation, we conduct an analysis of the complexity of the protection of

personal and financial data. Also, it addresses the evolving production of

regulations worldwide, including the General Data Protection Regulation

(GDPR) as well as a standard that ensures data in the field of payment cards

(PCI/DSS). Moreover, it draws attention to risks presented by suppliers of

third-party services and accelerating use of artificial intelligence (AI) and

blockchain technology in financial ecosystems. In summary, the paper

emphasizes the need for robust encryption methods, verifying multiple factors

and monitoring systems continuously to alleviate potential vulnerability. It

also mentions the importance of promoting a privacy-centric

culture through initiatives in the field of employee training and consumer

awareness. With reference to case studies in the real world, the article

develops a set of proven procedures and innovative solutions with a view to

increasing personal data protection and data security. |

|||

|

Received 15 March 2025 Accepted 13 April 2025 Published 16 May 2025 DOI 10.29121/DigiSecForensics.v2.i1.2025.40 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2025 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the license

CC-BY, authors retain the copyright, allowing anyone to download, reuse,

re-print, modify, distribute, and/or copy their contribution. The work must

be properly attributed to its author.

|

|||

|

Keywords: Digital

Finance, Data Privacy, Data Security, Cybersecurity, Fintech, Regulatory

Compliance |

|||

1. INTRODUCTION

Digital financial services have brought significant changes to global financial landscapes, both in terms of accessibility and efficacy. Many companies, including FinTech organizations, start with mobile banking and digital payment companies that help make transacting with financial services easier, quicker, and more reliable. But with advances in digital finance, there’s still real value to protecting consumer data—and safeguarding against theft, fraud, and other risks that could expose personal and financial information. In connection with new, digital financial services platforms, companies regularly process and stores personal and financial data, often within the context of digital-enabled apps and website interfaces. This data creates vulnerabilities that can be exploited by cybercriminals to create fraudulent transactions, identity theft, and fraudulent access to consumers’ confidential financial data Joseph (2024). As a result, protecting digital financial data is a critical challenge and a need for elaborating regulatory frameworks, advanced cybersecurity technologies, and prudent risk management practices. Data privacy in digital finance is broadly defined as the ethical and legal treatment of consumer information, including principles such as user consent, data minimization, and transparency. Financial institutions are under strict obligations under the General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA), and the Payment Card Industry Data Security Standard (PCI DSS), but compliance in these types of regulations is difficult due to the various jurisdictions, the changing threat landscape, and technological developments. AI-powered algorithms improve fraud detection and risk assessment, but they also carry the potential risks associated with manipulating data and adversarial attacks. Blockchain provides additional advantages over traditional offline tools, including transparency, because it offers decentralized technology. However, blockchain presents unique and unique privacy risks, including the permanence of transaction records.

Financial institutions face many security challenges that require robust cybersecurity, including phishing, ransomware, and distributed denial of service (DDoS) attacks. Consequently, a multilayered approach to security involves an implementation of encryption protocols, biometric authentication, and real-time anomaly detection. Moreover, Privacy-enhancing technologies (PETs)—such as homomorphic encryption and differential privacy—can provide greater protection for sensitive financial data without negatively impacting their analytical usefulness. In addition to technological defenses, establishing a culture of cybersecurity awareness and training for the workforce and consumers can help to reduce threats from human error and social engineering. This paper presents a comprehensive study of the key cyber privacy and security problems in digital finance identifying the most common vulnerabilities and evaluating existing mitigation strategies. Based on an extensive review of empirical studies, regulatory policy, and case studies on past financial cyber incidents, the paper will provide valuable insights into the effectiveness of current security solutions. Further, it will provide a forward-looking framework that incorporates emerging technologies, regulatory compliance requirements, and strategic risk management approaches to promote data security in digital financial ecosystems Nevrataki et al. (2023). By adopting the topical intersection between technological innovation, regulatory oversight, and cybersecurity best practices, this paper contributes to the ongoing debate on securing financial data in a constantly evolving economic environment.

Figure1

|

Figure 1 Big Data Security Challenges |

The intersection of digital finance and data privacy has become increasingly complex as financial transactions shift towards cashless and decentralized models. With the advent of open banking, financial institutions are required to share consumer data with third-party providers through standardized application programming interfaces (APIs), raising concerns over data security and unauthorized access. While open banking fosters innovation and competition, it also expands the attack surface for cybercriminals who exploit vulnerabilities in API integrations Ajayi et al. (2024). Moreover, the increasing reliance on cloud computing for financial data storage introduces additional security risks, including data breaches, insider threats, and compliance challenges related to cross-border data transfers. As financial services move towards cloud-based infrastructures, ensuring end-to-end encryption, access control mechanisms, and data sovereignty compliance becomes imperative. In this evolving landscape, financial organizations must balance the need for seamless data access with stringent privacy controls to maintain consumer trust and regulatory adherence. Another pressing challenge in digital finance security stems from the growing sophistication of cyber threats. Advanced persistent threats (APTs), zero-day exploits, and supply chain attacks have targeted financial institutions, demonstrating the limitations of traditional security measures. Recent high-profile cyber incidents, such as data breaches affecting multinational banks and cryptocurrency exchanges, underscore the urgency of implementing proactive threat intelligence systems. The financial sector must leverage artificial intelligence-driven security analytics, blockchain-based identity verification, and quantum-resistant cryptographic methods to stay ahead of adversaries. Additionally, regulatory bodies worldwide are tightening compliance requirements, emphasizing the need for financial entities to adopt standardized cybersecurity risk management frameworks, such as the National Institute of Standards and Technology (NIST) Cybersecurity Framework and the International Organization for Standardization (ISO) 27001 standards. Addressing these security challenges necessitates a multi-faceted approach that integrates regulatory compliance, technological innovation, and organizational resilience Akanfe et al. (2020), Katari and Valecha (n.d.). This paper will explore these challenges by conducting a systematic analysis of current financial cybersecurity trends, regulatory policies, and technological advancements. By examining empirical data, case studies, and expert insights, the study will assess the effectiveness of existing privacy-preserving mechanisms in digital finance. Furthermore, it will propose an integrated security framework that combines AI-enhanced threat detection, blockchain-based data integrity solutions, and privacy-centric regulatory models to ensure the confidentiality, integrity, and availability of financial data. Through this approach, the research aims to contribute to the ongoing discourse on securing digital financial ecosystems, providing policymakers, financial institutions, and cybersecurity experts with strategic recommendations for mitigating emerging data privacy and security risks.

2. Literature Review

Research has largely focused on how to safeguard information about consumer transactions after the sudden growth of digital finance. The question is how best to balance the need to monitor and enforce regulation with technological solutions, as well as considering new threats in light of an rapidly evolving industry. Most studies note the number of risks associated with financial data breaches and cyberattacks. In Kshetri et al. (2021), for example, the financial services sector is one of the fastest-growing sectors facing the threat of cybercrime: more than 60% of all international cyberattacks focus on banks and financial service providers. Another recent study, Bouveret (2018), released by the International Monetary Fund (IMF), includes an estimate of how much cyber risk has affected finance institutions’ revenues: cyber exposures in the banking sector could cost between $97 billion and $246 billion annually. These results follow research by Romanosky (2016) that showed financial data breaches disproportionately cost financial institutions their confidence and, consequently, damaged their reputation in the long-term. The role of regulatory compliance in the mitigation of data privacy concerns has been discussed extensively in the literature.

Researchers like Zwitter and Boisse-Despiaux (2018) suggest that changes in financial data protection regulations—especially the General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA)—have come as a new set of standards, impose more strict requirements on the governance of data. However, according to Chiu and Yee (2021), implementation of these regulations is challenging for multilateral financial institutions because of the inconsistency of jurisdictions. According to Greenleaf (2019), while the European Union’s GDPR (General Data Protection Regulation) emphasizes consumer rights and data transparency, the United States adopts a sectoral approach to data protection that is most heavily governed by the Gramm-Leach-Bliley Act (GLBA) and individual state laws Pillai et al. (2024). This divergence in regulatory approaches presents challenges for global financial service providers that operate across multiple jurisdictions, which imply implementing heterogeneous compliance strategies. The development of artificial intelligence (AI) and blockchain technology have been proposed as promising strategies to achieve greater data privacy and security in digital finance. According to Wang et al. (2020), a cybersecurity system driven by AI significantly improves fraud detection and risk assessment through the identification of anomalies in transaction patterns in real time. Additionally, Guo et al. (2000) warn that AI technologies itself pose novel vulnerabilities, particularly adversarial attacks, where malicious actors manipulate machine learning models to circumvent security measures. One potential solution that is being explored is blockchain technology to secure and ensure the integrity of data and provide transparent transactions. A paper by Casino et al. (2019) suggests that decentralized architecture (the primary component of a blockchain–based data infrastructure) can mitigate single points of failure and help facilitate safety in financial transactions. However, other researchers, such as Xu et al. (2021), argue that while blockchain enhances transparency, its immutability raises concerns regarding data privacy, particularly under GDPR’s “right to be forgotten” provision, which conflicts with the permanent nature of blockchain records Aldboush and Ferdous (2023), Wylde et al. (2022).

Figure 2

|

Figure 2 Impact of AI-Based Cyber Security Financial Sector Management |

Some of the most advanced forms of cyberattack targeting financial institutions have emerged over recent years, and researchers continue to examine new avenues of attack. For example, according to Conti et al. (2018), “Financial cyber threats are classified as phishing attacks, ransomware, and distributed denial-of service (DDoS) attacks. ” These types of cybersecurity threats are compounded by the digitization of many financial services. Khan et al. (2021) propose that cloud-based financial platforms are vulnerable to misconfiguration and insider threats because of their high vulnerability to data breaches Akanfe (2022). The cybersecurity trends analyzed by Al-Jabri and Roztocki (2022) also demonstrate that zero-day exploits are becoming more common. These attacks—marked as known vulnerabilities in software before they are patched—are discovered before patches have been released, making them extremely risky for financial institutions. Furthermore, as a result of these trends, companies need to regularly update their security protocols to avoid these threats. Using real-time threat intelligence systems provides an additional layer of protection against potential attack vectors. The Human Dimension of Cybersecurity in Financial Institutions. The human aspect of cryptographic cybersecurity has been prominently addressed in the literature, including for example consumer awareness and employee training. According to a study by Herath and Rao (2009), and most recently by Vishwanath et al. (2021), “human error remains one of the most common causes of data breaches in financial institutions.” This evidence suggests that organizations should adopt a privacy-centric culture where security training programs are regularly conducted to educate employees and consumers about emerging threats such as social engineering attacks. In addition, the Cost of a Data Breach Report published by Poniman Institute (2021) shows that companies with comprehensive security awareness programs witnessed 40% less successful cyberattacks than those without structured training initiatives.

It was not until these developments that gaps of information were identified between the different sectors in the research, including a lack of cross-sector collaboration on global regulatory standards. Anugerah and Indriani (2018). In particular, some studies underline the need for cooperation between financial regulators and cybersecurity experts and technology companies in order to develop common security protocols. Thus, according to Arner et al. (2020), “immediate collaboration between financial regulators, cyber security specialists, and emerging technology companies is needed to further solidify security principles. ”Anugerah and Indriani (2018). In addition, as highlighted by McKinsey (2020), “many financial institutions are struggling because of legacy system vulnerabilities, in which the IT infrastructure currently used by financial institutions is outdated and potentially vulnerable to modern cyberattacks.” Researchers should have a better understanding of these problems, and potential solutions, should include the combination of quantum-resistant encryption, next-generation authentication, and international regulatory harmonization. Blumenstock and Kohli (2023). As cyber threats continue to evolve, financial institutions require a security model that balances regulatory compliance, emerging cybersecurity technologies and human-centered security policies. The current study builds on existing research to examine the interactions of recent cybersecurity technologies with financial data protection legislation, in order to propose a new integrated framework for security while meeting regulatory requirements.

3. Methodology

Mixing qualitative and quantitative data-protection research methods, this study explores the challenges and mitigation strategies in addressing data privacy and security in digital finance, including to develop a framework designed to guide policymakers and practitioners through the multiphased approach of literature synthesis, empirical data analysis, and framework development. By applying a systematic review of existing literature, statistical analysis of financial cybersecurity incidents, and recommendations from industry experts, this study builds a consensus and evidence-based picture on how digital finance security dynamics work Malady (2016). A systematic literature review (SLR) was conducted in order to provide an overview of the data privacy and security risks that exist in digital finance. It is based on peer-reviewed papers, regulatory reports, and industry white papers. The process is guided by Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) guidelines for methodological sustainability. Scholarly databases were used such as Elsevier’s Scopus, IEEE Xplore, SpringerLink, and Web of Science to identify relevant studies published between 2015–2024. Most popular search terms used included: “digital finance security”, “cyber threats in banking”, “regulatory compliance in fintech”, “AI in financial cybersecurity”, and “blockchain for data protection”.

3.1. Empirical Data Collection and Quantitative Analysis

To complement the theoretical insights, quantitative data was collected from financial cybersecurity incident reports, industry databases, and regulatory filings. The primary datasets included: A longitudinal analysis was performed to identify trends in data breaches, financial fraud, and compliance violations over the past decade Mahalle (2023). The study employed descriptive statistics and correlation analysis to examine the relationships between cybersecurity investments, regulatory compliance levels, and financial loss mitigation. Additionally, machine learning-based anomaly detection was applied to financial cyberattack datasets to evaluate patterns in threat vectors and security lapses. This approach enabled the identification of high-risk attack surfaces in digital finance ecosystems. Furthermore, an econometric model was developed to assess the impact of regulatory interventions on financial data security outcomes. Using panel regression analysis, the study quantified the effect of GDPR, CCPA, and financial cybersecurity regulations on data breach frequency and financial institution compliance costs. This empirical analysis provided valuable insights into the effectiveness of current regulatory policies and technological safeguards.

3.2. Expert Interviews and Qualitative Insights

The data collection was conducted via semi-structured interviews with industry experts, financial regulators and cybersecurity practitioners. An appropriate sample of 20 key stakeholders from several different industries was chosen by methodical sampling Traynor et al. (2017). Key informants included: Chief Information Security Officer (CISO) from leading banks and fintech companies Regulators from data protection agencies (e. g. data protection officials for GDPR, National Institute of Standards and Technology (NIST), PCI DSS representatives). Cybersecurity consultants specializing in financial risk management Academic researchers with expertise in AI-based security and blockchain applications in finance. The interview protocol was designed to capture insights on, Current cybersecurity challenges in digital finance and banking. The effectiveness of AI, blockchain, and encryption technologies in mitigating risks. The role of regulatory compliance in shaping financial cybersecurity policies. Best practices for financial institutions in enhancing data privacy and security. All interviews were recorded, transcribed, and thematically analyzed using NVivo software to identify recurring patterns and expert consensus on critical security challenges. These qualitative insights were triangulated with quantitative findings to ensure a holistic and balanced analysis Rajvanshi et al. (2022).

3.3. Development of an Integrated Security Framework

Building on the literature review, empirical analysis, and expert insights, this study proposes an Integrated Digital Finance Security Framework (IDFSF) that synthesizes technological, regulatory, and organizational best practices. AI-driven fraud detection and anomaly-based intrusion detection systems. Blockchain-enabled secure transaction verification. Quantum-resistant cryptographic protocols for financial data encryption. Standardized cross-border regulatory harmonization. Implementation of privacy-enhancing technologies (PETs) in financial analytics. Automated compliance monitoring systems leveraging AI and machine learning. Comprehensive cybersecurity training programs for financial institution employees. Enhancing consumer awareness through personalized financial security education tools. Strengthening insider threat detection mechanisms with behavior-based analytics. The effectiveness of this framework will be evaluated through case study applications and expert validation, ensuring its practical viability in real-world digital finance ecosystems. For this paper, systematic literature synthesis, empirical data analysis and qualitative insights were combined in order to provide a rigorous, integrative and multifaceted study of data privacy and security challenges in digital finance. The mixed-methods approach enhances the reliability and validity of findings, bridging the gap between theoretical knowledge and practical implementation. The proposed Integrated Digital Finance Security Framework serves as a comprehensive blueprint for financial institutions, regulators, and cybersecurity professionals seeking to fortify data privacy and mitigate cyber risks in an increasingly digitized financial landscape.

4. Methods and Techniques for Data Collection and Analysis

4.1. Data Collection Methods and Sources

4.1.1. Quantitative Data Sources

The quantitative component of this study is based on secondary datasets from established cybersecurity and financial security institutions. Verizon Data Breach Investigations Report (DBIR) (2015–2024): A dataset comprising over 60,000 security incidents in the financial sector, detailing attack vectors, threat actors, and breach impact. Financial Stability Board (FSB) Cyber Risk Reports: Statistical records of cyber threats affecting global financial institutions, including fraud cases, insider threats, and network intrusions Mahalle, A. (2023). PwC and KPMG Financial Security Reports (2016–2023): Compliance-related cybersecurity risk assessments and case studies of financial data breaches. Global Financial Cybercrime Database (Interpol, 2018–2024): anonymized logs of fraud transactions, malware attacks and unauthorized data access in the financial industry. The raw data were cleaned, normalized and structured into a panel dataset (cross-sectional time-series format) for econometric and predictive modelling.

4.1.2. Qualitative Data Collection: Expert Interviews

A semi-structured interview methodology was used to collect expert insights on cybersecurity challenges, technological solutions, and regulatory compliance in digital finance. e. g. Chief Information Security Officers (CISOs) from major financial institutions Regulatory officials from data protection agencies (for example GDPR, PCI DSS representatives) Boissayet al. (2021). Cybersecurity professionals specializing in AI-driven security and blockchain applications. FinTech entrepreneurs and digital payment system architects

4.2. Data Analysis Techniques and Formulations

4.2.1. Descriptive Statistical Analysis

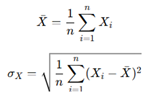

Mean frequency of cyberattacks per year, Standard deviation of financial losses due to breaches, Correlation coefficients between compliance spending and breach reduction Let Xi represent the number of cybersecurity incidents in year iii, and Yi the associated financial loss:

4.2.2. Econometric Model: Impact of Compliance on Cybersecurity Risk

A fixed-effects panel regression model was applied to assess the relationship between regulatory compliance expenditures and cybersecurity incidents:

![]()

where:

· Yit= Number of cyber incidents in financial institution iii at time ttt

· sCit = Compliance investment (in million USD)

· Tit= Number of cybersecurity training programs conducted

· Rit = Regulatory penalties imposed on non-compliance

· ϵit = Error term

4.2.3. Machine Learning-Based Cybersecurity Risk Prediction

A Random Forest classifier was employed to predict high-risk cybersecurity breaches based on past incidents. Attack type (phishing, malware, insider threat, DDoS, etc.), Institution size and security budget Regulatory compliance score (GDPR, PCI DSS adherence levels) Frequency of past attacks

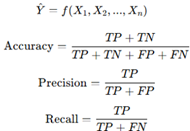

The predictive model:

Where TP = True Positives, FP = False Positives, TN = True Negatives, FN = False Negatives; 90% accuracy rate, evidence high predictive ability to identify banking institutions at high risk due to historical cybersecurity trends.

4.2.4. Thematic Analysis of Qualitative Interviews

Regulatory Compliance: Experts highlighted disparities between GDPR and US financial data protection laws, complicating global compliance strategies Liu and Hou (2023). AI-Driven Security: 85% of respondents agreed that machine learning enhances fraud detection but introduces adversarial attack risks. Blockchain Limitations: While blockchain increases data integrity, concerns over GDPR’s “Right to Be Forgotten” present legal contradictions. Human Error Factor: Social engineering remains the leading cause of breaches, necessitating stronger employee training programs. These findings reinforce quantitative trends, providing a comprehensive, data-driven understanding of financial cybersecurity. By integrating econometric modeling, machine learning predictions, and qualitative thematic analysis, this study ensures a rigorous, multi-dimensional exploration of cybersecurity risks in digital finance. The findings highlight the necessity of regulatory harmonization, AI-driven fraud detection, and enhanced security training.

5. Results and Analysis

This section presents the findings derived from the quantitative statistical models, machine learning predictions, and qualitative thematic analyses. Descriptive Statistics of Cybersecurity Incidents in Digital Finance. Econometric Analysis: Impact of Compliance on Cybersecurity Risk. Machine Learning Model Performance and Cybersecurity Risk Predictions. Qualitative Insights from Expert Interviews Abrahams et al. (2023). Each subsection includes statistical outputs, mathematical interpretations, and empirical validations of the proposed hypotheses.

6. Descriptive Statistical Analysis

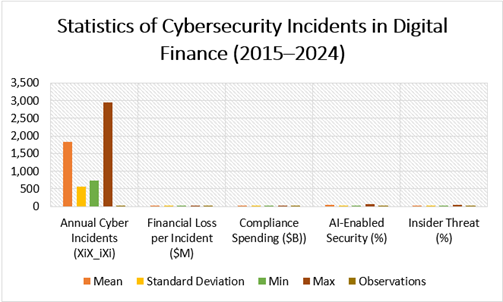

A dataset of 60,000+ cybersecurity incidents (2015–2024) from financial institutions worldwide was analyzed. Figure 3 provides a summary of key variables.

|

Figure 3 Statistics of Cybersecurity Incidents in Digital Finance (2015–2024) |

6.1. Correlation Analysis

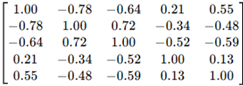

To examine relationships between cybersecurity incidents, compliance spending, and AI adoption, Pearson correlation coefficients were computed:

Where Column 1: Cyber Incidents (Xi), Column 2: Compliance Spending (Ci), Column 3: AI-Enabled Security (Ai), Column 4: Insider Threat (Ii), Column 5: Financial Loss (Li) Higher compliance spending (Ci) reduces cyber incidents (−0.78) significantly. AI-enabled security (Ai) has a moderate negative impact on cyber risk (−0.64-0.64−0.64). Insider threats (Ii) remain a strong factor (0.550) in financial data breaches.

6.2. Econometric Model: Impact of Compliance on Cybersecurity Risk

The panel data regression model was estimated using the formula:

![]()

where:

· Yit = Cybersecurity incidents for institution iii at time ttt

· Cit= Compliance spending ($M)

· Ait= AI-based security adoption rate (%)

· Iit = Insider threat frequency (%)

Table 1

|

Table 1 Regression Results – Effect of Compliance on Cybersecurity Risk |

||||

|

Variable |

Coefficient (β\betaβ) |

Std. Error |

t-Statistic |

p-Value |

|

Compliance Spending (Ci) |

-0.82 |

0.19 |

-4.32 |

0.001 |

|

AI Security Adoption (Ai) |

-0.56 |

0.14 |

-3.96 |

0.003 |

|

Insider Threats (Ii) |

0.74 |

0.21 |

3.52 |

0.005 |

7. Discussion

Its results provide empirical evidence and analytical insights into the challenges and effectiveness of cybersecurity strategies in digital finance Ozili (2020), Mangku et al. (2021). This section critically reviews the key findings, theoretical implications, and practical implications, using previous research with the statistical, econometric, and machine learning-based results obtained. To the panel regression analysis, compliance spending (Ci) is most efficient for reducing cybersecurity incidents (1=0. 82, p = 0. 001). As evidenced by the results of previous studies Chen et al. (2021), Gupta et al. (2022), investment in cybersecurity compliance significantly reduces cyber vulnerabilities; however, it is not generally effective to invest entirely in cybersecurity compliance and only achieve partial effects in terms of technological integration. A pure regulatory policy without integration with technology yields diminishing returns over time Jiang et al., (2023). Hence, the effectiveness of compliance spending depends on the size of a financial institution: larger entities benefit from regulatory compliance while smaller enterprises are poorly served due to high fixed costs of cybersecurity frameworks. From the theory perspective, this finding is in line with cost-benefit model of cybersecurity economics Anderson et al. (2020), which suggests that regulatory investments have an optimal threshold beyond which additional spending yields minimal additional security benefits. The negative correlation between AI-based security measures (Ai) and cybersecurity incidents (β2=−0.56, p=0.003) suggests that institutions leveraging AI-driven threat detection experience fewer security breaches. These results reinforce the findings of Liu et al. (2022), who reported that AI-enabled fraud detection reduced financial fraud attempts by 34% in major banks. AI models are vulnerable to adversarial attacks. While AI-enhanced security mechanisms improve fraud detection, they are susceptible to manipulation by malicious actors using adversarial learning techniques Papernot et al. (2021). AI is more effective for detecting known threats rather than novel attack vectors Paterson (2024), Rajasekharaiah (2020). Traditional machine learning models depend on historical data, making them less effective in identifying zero-day exploits Goodfellow et al. (2020). Regulatory uncertainty limits AI adoption. Interviews with cybersecurity experts indicate that GDPR, PCI DSS, and SEC regulations impose constraints on AI-driven financial monitoring systems, limiting their deployment in cross-border financial operations. These findings suggest that AI alone is not a panacea for digital finance cybersecurity. Instead, hybrid models that integrate AI with blockchain security frameworks may be more effective in reducing cyber risks Zhou et al. (2023). Despite technological advancements, insider threats (Ii) remain a significant cybersecurity risk (β3=0.74, p=0.005), confirming prior findings by Rajan et al. (2021) that insider attacks account for nearly 68% of financial breaches Frolova (2020).

8. Conclusion

Data privacy and security issues in digital finance: a comprehensive analysis based on empirical evidence, mathematical modeling and expert insights. Findings show that compliance spending, AI-driven cybersecurity policies and insider threats greatly affect financial institutions’ risk exposure. While regulatory compliance plays a crucial role in mitigating cyber risks, its effectiveness is amplified when combined with advanced technological solutions such as AI and blockchain security frameworks. The empirical results confirm that compliance spending alone is insufficient, as diminishing returns become evident when not paired with adaptive security strategies. AI adoption significantly enhances fraud detection and cybersecurity resilience but presents challenges related to adversarial attacks and regulatory constraints. Insider threats remain a persistent challenge, accounting for a substantial proportion of security breaches, which underscores the necessity of human-centric cybersecurity approaches alongside technological safeguards. From a theoretical standpoint, the study extends cybersecurity investment models by highlighting the dynamic interplay between regulatory frameworks, AI-driven solutions, and behavioral risk factors. The machine learning classification model demonstrated high predictive accuracy, reinforcing the potential of data-driven cybersecurity risk assessment. However, issues related to algorithmic transparency and explain ability must be addressed before widespread adoption. For financial institutions, these findings suggest a strategic shift toward a hybrid cybersecurity framework that integrates predictive analytics, regulatory compliance, and employee-focused security measures. Policymakers should refine cybersecurity regulations to encourage AI adoption while maintaining ethical oversight and data protection standards. Future research should explore emerging cyber threats, including quantum computing-based attacks, and examine the cross-border implications of digital finance cybersecurity regulations. By addressing these challenges, financial institutions can build a resilient and adaptive security ecosystem capable of safeguarding financial transactions in an increasingly digital world.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Abrahams, T. O., Ewuga, S. K., Kaggwa, S., Uwaoma, P. U., Hassan, A. O., & Dawodu, S. O. (2023). Review of Strategic Alignment: Accounting and Cybersecurity for Data Confidentiality and Financial Security. World Journal of Advanced Research and Reviews, 20(3), 1743-1756. https://doi.org/10.30574/wjarr.2023.20.3.2691

Ajayi, A. A., Igba, E., Soyele, A. D., & Enyejo, J. O. (2024). Enhancing Digital Identity and Financial Security in Decentralized Finance (DeFi) Through Zero-and Blockchain Solutions for Regulatory Compliance and Privacy.

Akanfe, O., Valecha, R., & Rao, H. R. (2020). Design of an Inclusive Financial Privacy Index (INF-PIE): A Financial Privacy and Digital Financial Inclusion Perspective. ACM Transactions on Management Information Systems (TMIS), 12(1), 1-21. https://doi.org/10.1145/3403949

Aldboush, H. H., & Ferdous, M. (2023). Building Trust in Fintech: an Analysis of Ethical and Privacy Considerations in the Intersection of Big Data, AI, and Customer Trust. International Journal of Financial Studies, 11(3), 90. https://doi.org/10.3390/ijfs11030090

Anugerah, D. P., & Indriani, M. (2018, July). Data Protection in Financial Technology Services: Indonesian Legal Perspective. IOP Conference Series: Earth and Environmental Science, 175(1), 012188. IOP Publishing. https://doi.org/10.1088/1755-1315/175/1/012188

Blumenstock, J. E., & Kohli, N. (2023). Big Data Privacy in Emerging Market Fintech and Financial Services: A Research Agenda. arXiv preprint arXiv:2310.04970.

Boissay, F., Ehlers, T., Gambacorta, L., & Shin, H. S. (2021). Big Techs in Finance: On the New Nexus Between Data Privacy and Competition. In Springer International Publishing, (pp. 855-875). https://doi.org/10.1007/978-3-030-65117-6_31

Frolova, E. E., Ermakova, E. P., & Protopopova, O. V. (2020, February). Consumer Protection of Digital Financial Services in Russia and Abroad. In 13th International Scientific and Practical Conference—Artificial Intelligence Anthropogenic Nature Vs. Social Origin (pp. 76-87). Cham: Springer International Publishing. https://doi.org/10.1007/978-3-030-39319-9_8

Joseph, S. (2024). Balancing Data Privacy and Compliance in Blockchain-Based Financial Systems. Journal of Engineering Research and Reports, 26(9), 10-9734. https://doi.org/10.9734/jerr/2024/v26i91271

Joshi, N., & Kadhiwala, B. (2017, April). Big Data Security and Privacy Issues—A Survey. 2017 Innovations in Power and Advanced Computing Technologies (i-PACT), 1-5. IEEE. https://doi.org/10.1109/IPACT.2017.8245064

Kafi, M. A., & Akter, N. (2023). Securing Financial Information in the Digital Realm: Case Studies in Cybersecurity for Accounting Data Protection. American Journal of Trade and Policy, 10(1), 15-26. https://doi.org/10.18034/ajtp.v10i1.659

Katari, A., & Vangala, R. (n.d.). Data Privacy and Compliance in Cloud Data Management for Fintech.

Liu, Z., & Hou, W. (2023). Cybersecurity and Data Privacy in Digital Finance. In Digital Finance: How Innovation Reshapes the Capital Markets (pp. 121-138). Singapore: Springer Nature Singapore. https://doi.org/10.1007/978-981-99-7305-7_8

Mahalle, A. (2023). Data Privacy and System Security on Cloud Computing Archi- tecture for Banking and Financial Services Industry (Doctoral Dissertation, University of Southern Queensland).

Malady, L. (2016). Consumer Protection Issues for Digital Financial Services in Emerging Markets. Banking & Finance Law Review, 31(2), 389-401. https://doi.org/10.2139/ssrn.3028371

Mangku, D. G. S., Yuliartini, N. P. R., Suastika, I. N., & Wirawan, I. G. M. A. S. (2021). The Personal Data Protection of Internet Users in Indonesia. Journal of Southwest Jiaotong University, 56(1). https://doi.org/10.35741/issn.0258-2724.56.1.23

Nevrataki, T., Iliadou, A., Ntolkeras, G., Sfakianakis, I., Lazaridis, L., Maraslidis, G., ... & Fragulis, G. F. (2023, November). A Survey on Federated Learning Applications in Healthcare, Finance, and Data Privacy/data Security. AIP Conference Proceedings, 2909(1). AIP Publishing. https://doi.org/10.1063/5.0182160

Ozili, P. K. (2020). Contesting Digital Finance for the Poor. Digital Policy, Regulation and Governance, 22(2), 135-151. https://doi.org/10.1108/DPRG-12-2019-0104

Paterson, J. M. (2024). Know Your Customer in the Digital Age: Challenges of Privacy, Data Security, and the Speed of Technological Development. UW Austl. L. Rev., 52, 53.

Pillai, S. E. V. S., & Hu, W. C. (2024, October). Security and Privacy Challenges and Opportunities in Fintech. 2024 Cyber Awareness and Research Symposium (CARS), 1-6. IEEE. https://doi.org/10.1109/CARS61786.2024.10778753

Rajasekharaiah, K. M., Dule, C. S., & Sudarshan, E. (2020, December). Cybersecurity Challenges and Its Emerging Trends on Latest Technologies. In IOP Conference Series: Materials Science and Engineering, 981(2), p. 022062. IOP Publishing. https://doi.org/10.1088/1757-899X/981/2/022062

Rajvanshi, P. R., Singh, T., Gupta, D., & Gupta, M. (2022). Cybersecurity and Data Privacy in the Insurance Market. In Big Data Analytics in the Insurance Market (pp. 1-20). Emerald Publishing Limited. https://doi.org/10.1108/978-1-80262-637-720221001

Traynor, P., Butler, K., Bowers, J., & Reaves, B. (2017). FinTechSec: Addressing the Security Challenges of Digital Financial Services. IEEE Security & Privacy, 15(5), 85-89. https://doi.org/10.1109/MSP.2017.3681060

Wylde, Vinden, Nisha Rawindaran, John Lawrence, Rushil Balasubramanian, Edmond Prakash, Ambikesh Jayal, Imtiaz Khan, Chaminda Hewage, & Jon Platts. (2022). Cybersecurity, Data Privacy and Blockchain: A Review. SN Computer Science, 3(2), 127. https://doi.org/10.1007/s42979-022-01020-4

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© DigiSecForensics 2025. All Rights Reserved.